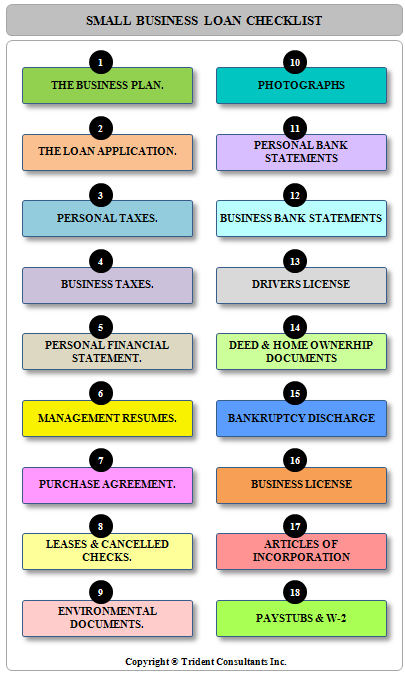

The second scenario should reveal how your business will be able to produce better outcomes once you receive a small business loan. The first scenario will illustrate how you believe your business will perform without any additional financing. To secure a loan, you should create two future scenarios. This is because your budget and future cash flows are only projections, and lenders know that conditions can change. For example, business owners often use their additional financing to:Īlthough business lenders will want you to be as specific as possible with your plans, you’ll be afforded some freedom with your claims. When considering you for a loan, lenders will want to know how your business plans to utilize the financing, and what your future plans are. If your liabilities substantially exceed your current assets, you may have a more difficult time securing a small business loan with a low interest rate. Essentially, the purpose of a balance sheet is to illustrate what your business currently owns and how much you currently owe. While your income statement is a historical report, your balance sheet is a snapshot of your current financial situation.Ī balance sheet will represent your business financial components, such as:Įach of these figures will be very important to business financing lenders. There are several differences between an income statement and balance sheet. Even if your expenses exceed your revenues - which is often the case for newer businesses - all types of lenders will want to view your income statement. Income statements are very useful for business lenders who want to understand how a business has performed over the past year(s). Generally speaking, an income statement will be clearly divided into columns of revenues and expenses. Your income statement is a report of how your business has historically experienced cash flows. Although writing off a significant portion of your taxes can allow you minimize your annual expenses, having too many tax deductions may create some complications with potential lenders. When filing your taxes, it’s important to balance maximizing deductions while maintaining the image of consistent revenue. If your business is brand new, you should ask your accountant to help you create a projection of what your tax returns might look like in the upcoming year. Your business’ income tax returns can illustrate how your business has performed in the past. Due to this, it’s important that your financial statements reflect this. Lenders are much more likely to lend to businesses that they believe are actively earning revenue while managing their expenses in a healthy way. Not only can they prove the legitimacy of your business, but they can also help you defend your future cash flow expectations. Usually, small business lenders will want to review your business’ bank account statements. In addition, you can correct any mistakes on your report prior to submitting your application. Having a credit report available when applying for a small business loan can be beneficial if you have an exemplary score that will make you an ideal loan recipient. This way, factors such as late payments on old student loans won’t affect your lendability as a business owner. Usually, it’s recommended that you try to create a separate legal entity for your business (LLC, Partnership, Corporation, etc.). The differences between your personal and your business credit histories will depend on the specific structure of your business. In some cases, they may require collateral to secure the loan.

#THE BEST BUSINESS PLAN TO GET A LOAN FULL#

To gain access to additional capital, your business should ideally be able to demonstrate a history of paying back loans in full and on-time.Īlthough having a poor business or personal credit score won’t necessarily make it impossible to get approved for a loan, it’ll likely prompt lenders to give you higher interest rates or smaller loan amounts. What Do I Need to Get a Business Loan? Six Common Business Loan Documents for Your Application: 1. Typically, the more information that small business owners can provide to business lenders, the easier it’ll be to get quickly approved. In this post, we’ll discuss documents that are frequently requested by lenders in the loan application process. If these documents aren’t provided, or if incorrect information is supplied, it could lead to your business getting denied from receiving necessary funding. 6. Budget and Future Cash Flow Projectionsĭepending on the business lender, there may be several documents required in order for you to qualify for a business loan.What Do I Need to Get a Business Loan? Six Common Business Loan Documents for Your Application.

0 kommentar(er)

0 kommentar(er)